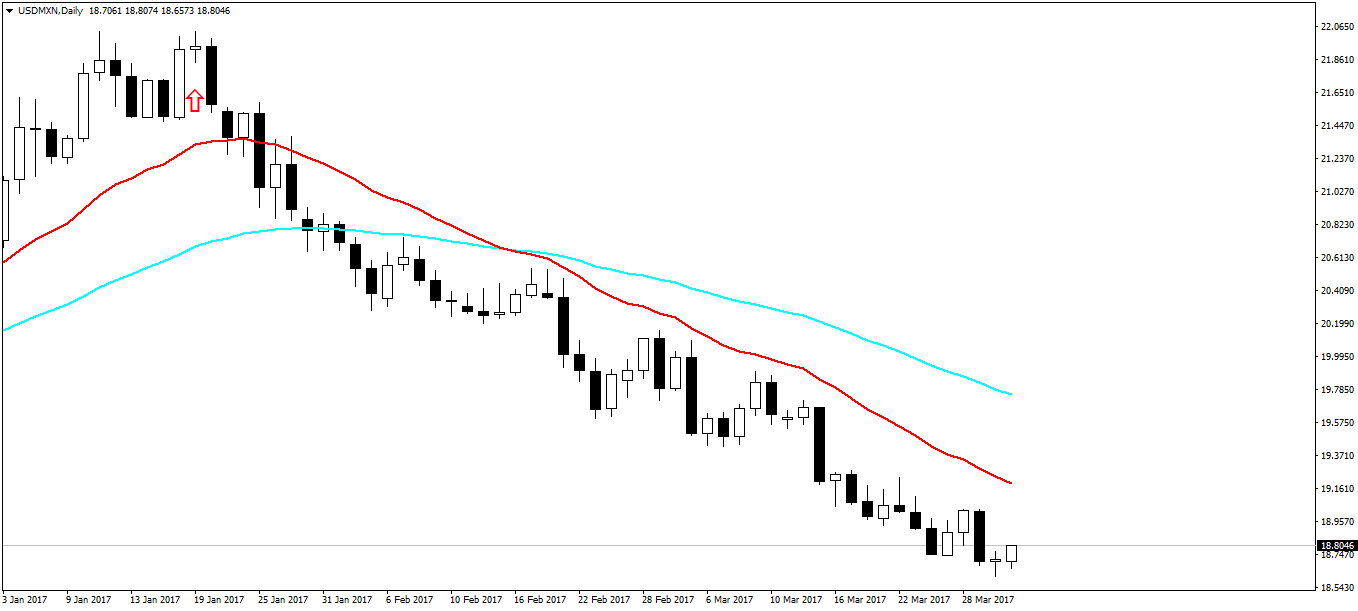

Have you ever traded USDMXN pair? USDMXN is an exotic pair. MXN is the Mexican Peso. Did you read the post on how to trade headlines news and magazine cover stories? Mexican Peso MXN has been in a lot of headlines in the last few months. Especially after President Trump coming to White House, there has been a lot of talk by him on building the wall. This type of talk makes Mexican Peso a bit jittery. On the day of US Presidential Elections that is November 8th, 1 US Dollar was equal to 18.50 Pesos. Then Trump became the President with lot of talks about building the wall. At one point 1 US Dollar was equal to 22 Mexian Pesos. At that point the Mexican Central Bank took decisive action by raising the interest rates. Then President Trump faced one set back after another set back in US domestic policy. This was reassuring to the Mexican Peso and it is almost back to where it was on November 8th last year. Did you watch this Institute of Trading and Investment Brazil documentary? Take a look at the following screenshot of USD/MXN. This is the daily chart of USDMXN.

In the above chart, you can see USDMXN in a long term downtrend. Red arrow in the above screenshot shows the highest that USDMXN went. It was 22.0358. I don’t trade USDMXN. But I am planning to trade exotic pairs like USDMXN. So hypothetically by placing a pending sell limit order at 22.0300, we could have entered into a well good sell trade that would have made us some 4000 pips. You can see from the above screenshot, USDMXN has been trending down for many weeks now. As said in the beginning of this post, USDMXN is now trading almost at the level where it was before the US Presidential Elections. Did you watch this Institute of Trading and Portfolio Management South African documentary? If you are getting bored reading this post, you can watch this Institute of Trading and Portfolio Management South African documentary. Also don’t miss watching the Brazil documentary.

Now when you trade these exotic pairs like USDMXN make sure you have a clear grasp of what drives these currencies. Exotic pairs trend a lot. Exotic pairs like USDMXN today behave in much the same manner as the commodities future market used to behave in the 1970s and early 1980s when legendary traders like Bruce Kovner and Richard Dennis made a killing trading those trends. Major pairs have totally changed their behavior. But these exotic pairs today are behaving in the same manner that commodities futures market would behave a few decades back. Then the commodities futures market also changed. Have you read about the Turtle Trading System? The point I am making is that Turtle Trading System may still be very profitable trading these exotic pairs like USDMXN. Read this post on a naked trade that made 1000 pips in 7 days.

When you trade these exotic pairs you should first check with your broker the spread that is being charged. Spread is a variable thing. Brokers keep on varying it. At times of volatility, brokers suddenly widen it. Most of the brokers are charging 50-100 pips spread on USDMXN. Oanda is charging 600 pips. So you should check before you make any trades. Macroeconomics play an important role when trading these exotic pairs like USDMXN. Mexican economy is heavily dependent on US economy. Both are neighbor so Mexico and USA are big trading partners. Talks of building a wall and stopping illegal immigration is hurtful to the Mexican economy. This is why Mexican Peso becomes jittery whenever there is a chance that Mexican economy might get hurt.Did you read the post on Long Short Term Neural Network Trading System?

Most traders have never taken a course on macroeconomics. Macroeconomics give you big picture of a particular country economy. You look at the imports and exports and the trade surplus. You look at the level of unemployment in the economy. All these thinks help you understand the economy of that country better. This can help you in becoming a better trader as well. I have developed this course Macroeconomics for Traders. In this course I explain the macroeconomics fundamentals that can help the traders in trading these exotic pairs.

Now I was reading an article on Bloomberg that says that hedge funds are training their computers to think like you. For many years, hedge funds have been trying to develop algorithms that can think like manual traders. Today you will be surprised to know that more than 80% of the trades that are being placed at Wall Street are being placed by algorithms. We are entering into a the age of algorithms. The days of manual trading are coming to an end. You should also start learning machine learning and artificial intelligence and use that in your trading strategies. Did you take a look at my course Wavelet Analysis for Traders? In this course I teach you wavelet analysis and show you how you can use wavelets in predicting the turning points in the market.