USDCHF made history last year in January when it fell around 2000 pips in just 5 minutes when the Swiss National Bank (SNB) remove the EURO-CHF peg. You can read the post here where I have provided all the details of what happened on that day. On that day, a number of forex brokers suffered huge losses that included FXCM whose loss was around $300 million. That day many currency traders who were on the wrong side of the market also saw their accounts get blown up as stop losses didn’t work that day. Why? USDCHF fell so fast that there was no one to take the buy side of the trade for the stop loss to work. So this is a word of caution for you there can be extremely volatile times in the market when stop loss don’t trigger. In this post we discuss how to trade USDCHF naked on daily and H4 charts. Take a look at the following screenshot!

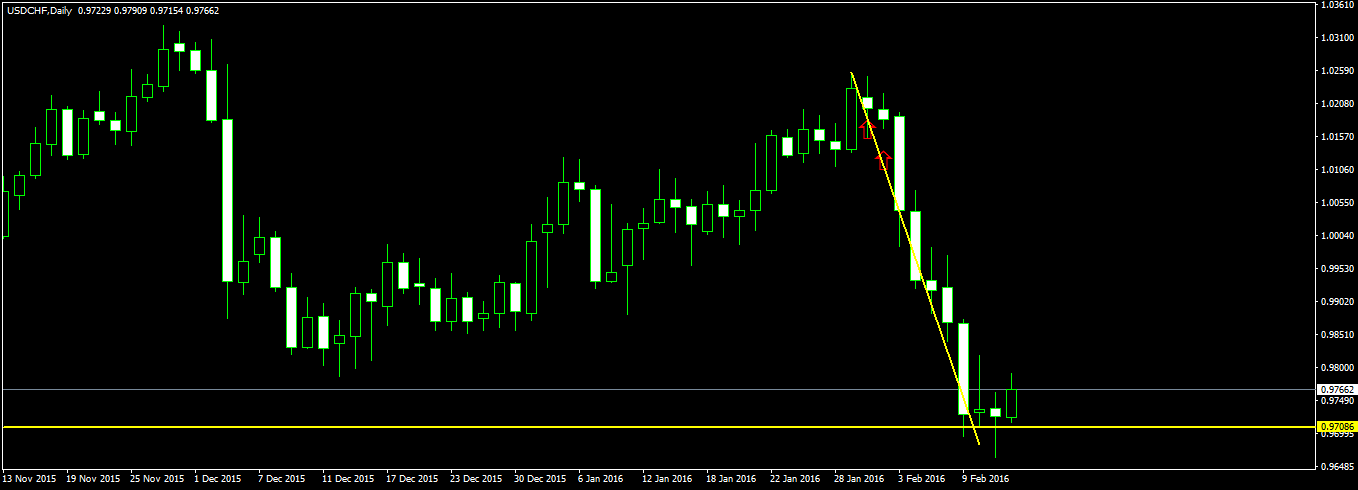

In the above daily chart screenshot you can see massive bearish candles being made by USDCHF. It fell more than 500 pips in 7 days. So how do you know that USDCHF is going to fall massively in the next couple of days? You can find out what USDCHF is planning to do in the next couple of days by looking at the candlesticks. The first red arrow in the above candlestick is showing an inside bar pattern. An inside bar pattern is a powerful trend reversal signal on the daily timeframe. But how do we know that today the daily chart will make an inside day bar? For that you need to take a look at the 4 hour chart. Take a look at the USDCHF H4 chart below!

In the above screenshot of USDCHF H4 chart, you can see an side bar just above the red arrow. The next candle is also unable to break the high of the previous candle which is a signal that downtrend is in place. So we make an entry at 1.02237 just at the close of the H4 candle with 1 standard lot and place the stop loss at 1.02500 giving us a risk of 27 pips. In dollar terms this is $270 and if you have $10K in your account, this means a risk of 2.7%. Our profit target is 500 pips.Experience tells us that USDCHF has the ability to fall 500 pips in in the next few days.

We open another position just above the second red arrow at 1.01843 with one standard lot and move the stop loss to 1.02200. So the first position becomes break even and our risk is now 36 pips which in dollar terms means $360. We have the same profit target of 500 pips which translates to a price level of 0.97237. After on day we move the stop loss to breakeven for the second position. From now on our trade is risk free. The profit target level is hit on the 7 day.

The first position made a profit of $5K and the second position made a profit of $4610. So the total profit was $9610 in 7 days. This is an example of trend trading. Trend trading entails a lot of patience and discipline. Always remember trend is your friend until it bends. You can watch these videos that explain how to trade with the trend.