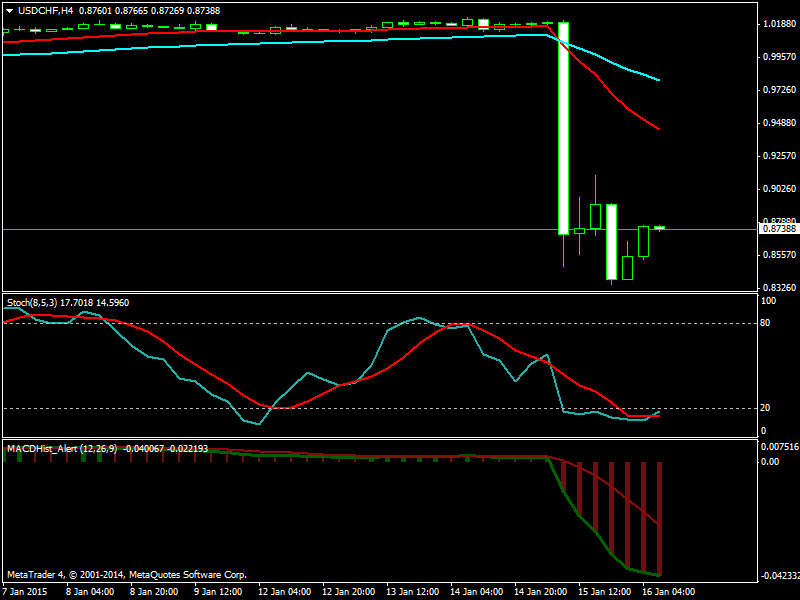

Yesterday USDCHF fell from 1.02205 to 0.83527 in just one day. This was a massive fall of 1867 pips that happened when Swiss Franc appreciated massively on the Swiss National Bank (SNB) policy announcement that it was removing the Swiss Franc peg with the Euro. If you had planned to trade the Swiss National Bank policy announcement yesterday, you could have easily made 1867 pips with a risk of only 25 pips. Take a look at the following USDCHF H4 chart below!

Now SNB had pegged Swiss Franc with Euro at the rate of 1.20 franc for 1 euro. Just last month, it had announced that it would defend the peg vigorously. The Swiss franc’s 41 percent surge after the central bank unexpectedly lifted its cap against the euro is one of the biggest moves among major currencies since the collapse of the Bretton Woods system in 1971. Unlike previous foreign-exchange upheavals, today’s action occurred to one of the most-traded currencies that is considered a haven in tumultuous times, and few saw the move coming.

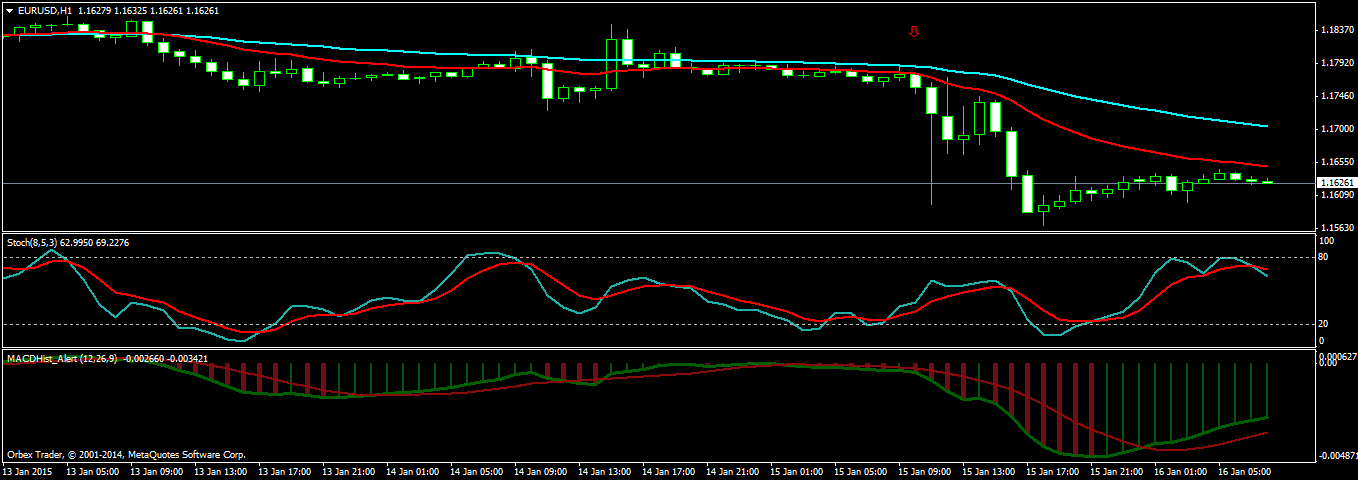

When SNB was making the announcement for removing the peg, EURUSD, NZDUSD, GBPUSD, AUDUSD all currenecy pairs showed massive volatility that surprised the currency traders. Take a look at the EURUSD chart below that shows the big candle formed on the policy announcement with a red arrow.

Markets were caught off guard Thursday when the Swiss National Bank (SNB) canceled its policy pegging the exchange rate of the euro buying 1.20 Swiss francs, a policy put in place more than three years ago to keep the currency from getting too strong and hurting the economy. The SNB also cut interest rates deeper into negative territory, by 50 basis points to negative 0.75 percent, in an effort to help cushion the blow.

This move by the Swiss National Bank is accelerating the EURUSD fall towards 1.000 level.