Just a few hours ago, Reserve Bank of New Zealand (RBNZ) cut interest rate by 20 basis points in an attempt to weaken New Zealand Dollar (NZD) and NZD did the just opposite. NZD shot up and strengthened 1%. New Zealand’s central bank chief faced the galling sight Thursday of the currency surging 1 percent to a one-year high immediately after he cut his benchmark interest rate by a quarter point to 2 percent, a fresh record low. The market had wanted more than Wheeler was prepared to give — either a half-point rate reduction or a signal of much deeper cuts ahead. To some, it looked like a boxing match with a clear loser.

Reserve Bank Of New Zealand RBNZ

Job of a central bank is to keep inflation low and unemployment low. The monetary policy tools that a central bank uses to accomplish its task of controlling inflation and unemployment are interest rates and money supply. Central banks are the only banks that can create money out of thin air. This magic is accomplished in reality by printing money. Federal Reserve Bank has been doing it on a massive scale after the financial crisis of 2008. European Central Bank has also been doing it. So can other central banks. Each bank has the power to create its own currency meaning they have no control over other currencies. This makes the job of these central banks challenging in today’s interlinked world.

https://www.youtube.com/watch?v=aW66lx33qFc

The MONIAC System

Above video has been made by RBNZ Did you see the part that talked about the MONIAC system that has been developed by RBNZ. We hope they didn’t use this MONIAC system for predicting the market reaction to their interest rate cut decision. In the end of the above video, it is being said that RBNZ uses complex mathematical equations to model the economy and the financial markets. RBNZ will have with it some econometric models that tell it how the economy and the markets are going to react to its rate cut decision.

https://www.youtube.com/watch?v=FeFwyWcIHts

Today’s markets are highly complex and interlinked globally. You do something and the market does exactly the opposite. This is precisely what happened today. RBNZ lowered interest rates from 2.20% to 2% but the market reacted wildly strengthening NZD by 1% forcing the Governor RBNZ say, ” We have very limited control over the exchange rate.”

Reserve Bank of New Zealand Monetary Policy Statement

Before issuing the above monetary policy statement, the Governor and his staff must have run some computer simulations of the possible reaction of the currency market to their rate cut decision. On the basis of the results of that computer simulation they must have been concluded that they will achieve the desired result of weakening New Zealand Dollar.

On the other hand, the market had wanted RBNZ to cut the rates more. When Governor announced a rate cut of 20 basis points, market reacted and NZD shot up strengthening by 1%. This was a signal by the currency market. Rate cut of 20 basis points is not enough. In the coming months, we believe RBNZ will satisfy the market by cutting interest rates more and more.

Interest Rates And Stock Prices

Inflation is running very low in the Kiwi economy. Low inflation is a phenomenon known as disinflation. Strong New Zealand Dollar is making it hard for RBNZ to bring inflation between 1-3% band. So expect RBNZ to do its utmost to weaken NZD. Traditional finance theory says that interest rate increase should decrease stock prices as more people take advantage of higher interest rates by investing more in bonds. In the same manner, decrease in interest rate should increase stock prices as people start selling bonds due to low yield and start buying stocks. But just keep this in mind that in today’s finance there is no linear relationship between interest rates and stock prices and for that matter currency prices. Central bank can increase interest rate and stock prices can continue to rise. In the same manner central bank can decrease interest rate and stock prices can continue to fall.

Now this was not the first time that market reacted exact opposite to what the central bank had planned. In the past markets have stunned central banks. Federal Reserve Bank of USA has highly sophisticated mathematical models that make the predictions but even they get surprised by the market reactions. Central banks are still the most important players in the market. But today these central banks have limited power over the markets. Markets do what they want to do. Have you seen Institute of Trading and Portfolio Management Brazil Documentary?

Expect A Long Term Downtrend on NZDUSD

This is an important lesson for traders like you and us. Market reaction can be wild and totally unexpected. Sometimes the predictions can go terribly wrong. What this means is that we should always respect the markets. Now this is was knee jerk reaction by the market which may not be a long term reaction. In the long term we should expect RBNZ to win and weaken NZD. So look for a long term downtrend to start on NZDUSD in the coming weeks that might continue for many months. Watch this Institute of Trading and Portfolio Management South Africa Documentary.

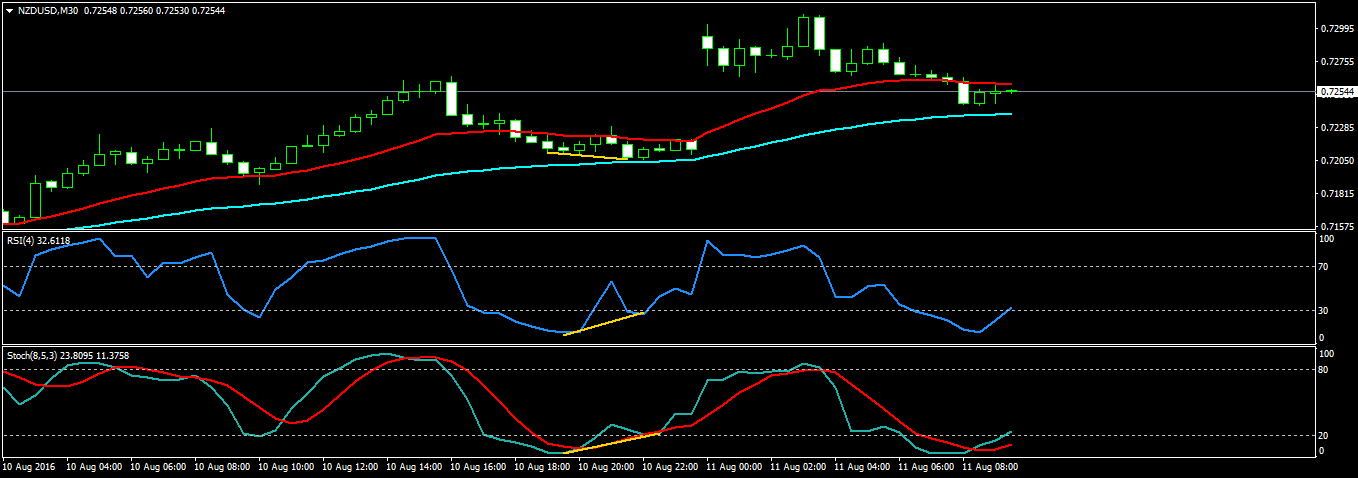

As a trader you should learn to believe in the charts. What that chart says, you should do accordingly. If you find a divergence signals, then you should take it seriously. In the screenshot below you can see RSI and Stochastic showing a strong divergence on M30. This was a signal that the market is going to move up and it did just that. It moved up. Now this divergence signal does not tell you how much up the market will move.

In the above screenshot you can clearly see divergence on NZDUSD M30 chart. It was a clear signal that the market will go up. Now a divergence signal is just a signal that price is going up. It doesn’t mean it will go up forever. As said above RBNZ will try its utmost to bring down NZDUSD. So we should have a bearish outlook for NZDUSD in the long term. In between it can go up and down.