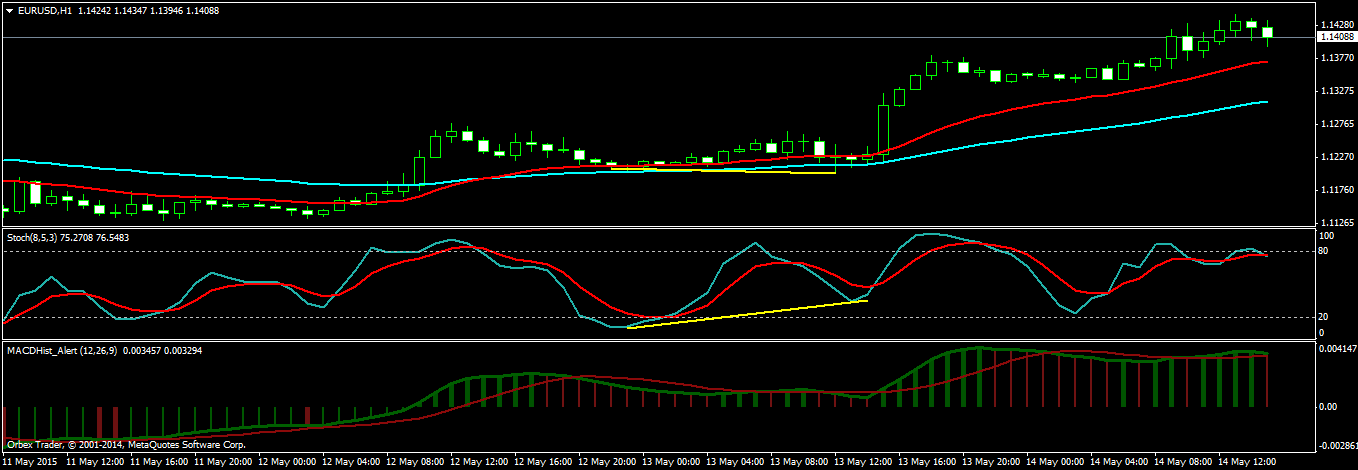

EURUSD has jumped up more than 200 pips in the last 24 hours. Infact EURUSD has jumped up more than 300 pips in the past 3 days on the US poor economic data. Take a look at this EURUSD H1 chart that shows a strong bullish divergence signal that appeared 24 hours before.

This was the bullish divergence pattern that appeared yesterday and since then EURUSD has moved up 200 pips. After a few hours there is a important ECB Press Conference by Mario Draghi.

The dollar fell to its weakest against a basket of major currencies since the launch of euro zone quantitative easing in January on Thursday, hit by growing concern that the U.S. economy has not just been suffering from a winter chill.

The downtrend that has started last year in June is over. Since last month EURUSD has gained almost 1000 pips and the talk of EURUSD reaching parity level is over for now. It all depends on the US economic data and when the FED decides to raise the interest rates. With poor US economic data, FED may not take the risk of increasing interest rates soon.